The 2020 US Election Uncertainty Cure For Investors

Summary

- A Trump or Biden win wouldn’t make much of a difference to the stock market on the long-run because of the Fed’s loose monetary policy.

- Focusing on growth stocks with a long-term value potential and ignoring short-term dips is a reasonable strategy to sail against pre and post-election uncertainty.

- Green energy stocks might experience an election outcome-related dip in prices, but this is an example of an asset class that might experience exponential growth on the long-run.

- A contested election might lead to more volatility in the stock market, although this will probably wither quickly.

Americans may not agree on much today, but one thing that is a consensus among average Americans that are following the financial markets is the election results will shake up markets irrespective of who wins.

As players in the market, the question is then, how do we position our portfolios to benefit from the market movements that will occur from the announcement of the winner until after inauguration?

Should we even bother staying invested in certain asset classes during this period of uncertainty?

To answer this question, it’s important to examine the potential reaction of the markets if the results of election go in favour of Trump, Biden, or is contested.

A Trump victory

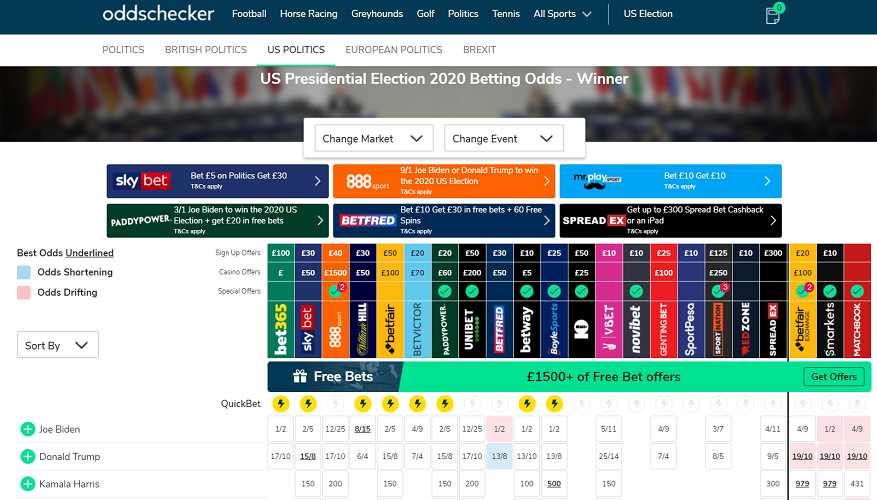

I haven’t seen a bookie in the UK that didn’t place Trump as the underdog in the 2020 US election. Look at the image below to have an idea about what I mean.

Most polls have even predicted a landslide victory for Biden.

However, one thing we should have learned from the 2016 US election and the Brexit referendum that same year is that polls and bookies can be wrong.

The polls and bookie odds don’t account for the secret Trump voters and other variables such as electoral college vote in swing states that could increase his chances of winning.

Perhaps UK punters feel this disconnect, which is why a majority of them are backing Trump to win. In fact, one of my friends told me of his flatmate placed £700 backing Trump to win. This will leave him with hefty returns because the odds are against Trump.

Besides, a 30-36% implied probability of winning is still a good chance that Trump could retain his sit as the 45th president of United States of America.

What will a Biden’s victory mean for the economy?

- Green energy assets may see a rally in prices

- Oil and gas may see a short/long-term fall in prices

- A rollback on Trump’s tax cuts and a reinstatement of payroll tax for the top earners

- Minimum wage may be increased

- Trade tensions with China will be eased

- His ‘Buy American’ and ‘Build Back Better’ plan may boost manufacturing and infrastructure

- Financial stocks may suffer

- Technology stocks may suffer

- Marijuana stocks may soar higher

- Potential short-term sell off in the stock market because of Biden’s proposed tax cut roll backs

- Weaker dollar on the short term and a stronger dollar on the long term

- More engagement with the world

A contested election

This US election may see a record levels of mail voting because of the Coronavirus pandemic. Given Trump’s rhetoric on voting fraud and corruption, the result of the election could be contested and this might last for weeks. This will lead to more volatility in the stock market on the short-run but I don’t see this lasting any longer.

A case to be invested

The overstretched company valuations and uncertainty surrounding the US elections might seem like a good reason for one to hold more cash but this may not be the best option on the long-run because it could leave one missing out on huge gains that might occur over the next few weeks or months.

Staying actively invested because of the Fear of Missing Out (AKA FOMO) shouldn’t be the basis for remaining invested but the next point below.

A case to long growth stocks with long-term value potential

The Fed remains the same irrespective of who wins and its promise to maintain a loose monetary policy for a few years (up till 2023) means the rally in the stock market will continue on the long-run and growth stocks with long-term value potential are the perfect options to benefit from this windfall.

This means investors should focus on stocks that have a potential for long-term growth irrespective of if they experience short-term fall in prices depending on who wins.

Green energy is an example of a sector that houses long-term growth stocks that could stand the test of time, even though green energy stocks could see a short-term dip if Trump wins. The increasing popularity of green energy has made it a preferred choice in the eyes of consumers and government officials around the globe.

One of the biggest arguments against green energy is the high setup costs, however, this has been on a downward trend over the past few years. Renewable energy is now one of the cheapest sources of energy, even without subsidies. This presents a great opportunity for investors to position their portfolios to benefit from this trend.

Conclusion

Staying actively invested in growth stocks with long-term value potential is perhaps the best strategy for investors in a time of economic and political uncertainty. Not only will this protect your portfolio from inflation which might run amok, but it could leave you with a healthy return in a period of low interest rate.