How to Smartly Attack Your Student Loan With Technology

There is roughly $1.2 trillion in out-standing student loan debt in the U.S right now. Which means a lot people are miscalculating their financial standing, and misjudging their future incomes.

By an estimate, nearly 10% of people default 2 years after graduation, and the number rises by the years the post-graduate is extended. Stats like these discourage many underprivileged hopefuls from ever attending college, simply because they don’t know the system, and, more importantly lack the financial education to smartly manage their expenses after taking on the student loan.

One of the biggest contributing factors to the ongoing increase in unpaid student loan debt, is the sheer deficiency of literacy of student loan debt management. Students are often left at the mercy of banks that hand out these loans. They purposely hide some information, or present certain clauses as good and non-threatening, causing students to get trapped knee-deep in debt, which only continues on compounding.

Not only does this become a cause of emotional distress, but it often directly affects their academic performance, and then later, their professional careers; due to an unfavorable credit history.

Thankfully, a number of great start-ups have emerged recently, with the aim of helping students willing to take on loans for their education. Their solutions range from increasing student loan literacy, to figuring out the most appropriate and personalized loan type, to managing daily expenses through carefully crafted mobile apps.

A number of them are listed below.

SoFi

SoFi is a startup that helps you optimize your monthly debt payments. Through an easy-to-use interface, it collects information with you, and if you meet certain eligibility requirements, it presents you with a range of customizable loan options to choose from. Things like loan terms, fixed or variable rates and such.

Eligibility factors include your country, outstanding student loan amount, employment status, graduation status, university name, personal credit history and current income.

Student Loan Hero

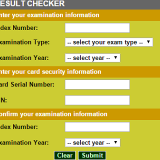

Student Loan Hero is a free solution for borrowers that lets them manage their student loans efficiently. Using this requires you to upload your financial information, after which the platform presents a set of customized recommendations and does more like reminding you of outstanding bills. It also contains a bunch of calculators for more granular debt management.

Gradible

What if an online platform could offer you jobs that helped you pay off your student loan debt in your spare time? That’s exactly what Gradible does. Tasks vary from posting to Facebook, blog writing, and more. When you complete your tasks, you earn “credits” which can be redeemed, allowing for Gradible to make payments to your lender. In a review of Gradible, it was highlighted that most users earn about $10-$15 per hour for completing their tasks.

Achieve Lending

Through Achieve Lending, potential borrowers can compare rates on private student loans with ease. It’s distinctive feature is the ability to personalize loan rates and amount according to your current standing. It does so by cross referencing your financial position with the best arrangement of loan and rates you qualify for. Aside from that, this tool works wonderfully as a scale to judge the current market.

LendKey

In the market of providing student loan solutions to borrowers, LendKey stands out from most. They have connections with community leaders, banks, credit unions and other key institutions. This allows them to have some of the lowest student loan refinancing rates available in the market.

About the author: Henry Kingston is a product of Depaul University and a passionate finance blogger.

About the author: Henry Kingston is a product of Depaul University and a passionate finance blogger.